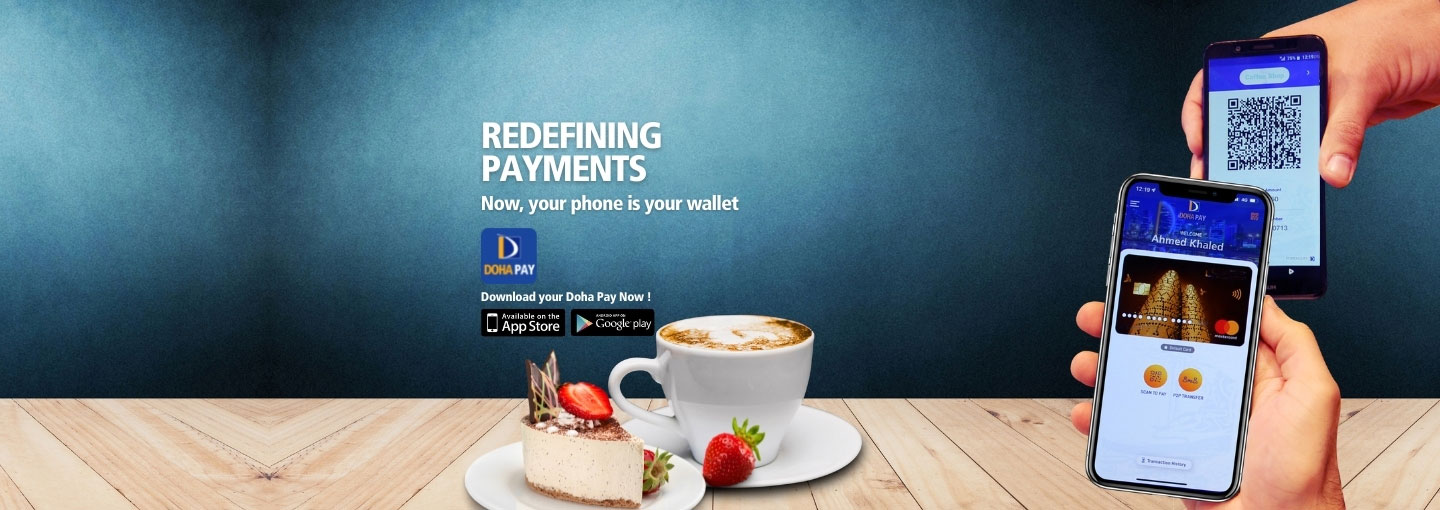

Doha Pay

Doha Pay brings new dimension to your wallet! Enjoy quick, safe, and seamless payments by adding your Doha Bank Credit or Debit Cards to your Doha Pay wallet.

Download Your App Now

FAQ’s

Doha Pay is a converged card based mobile wallet which allows Doha Bank customers to make quick, easy, and secure payments on the go. With this wallet, the user will not need to carry cash or physical cards anymore as the cards (Doha Bank Debit / Credit) will be digitally stored in a secured manner onto their mobile devices.

Doha Pay wallet enables the user to make cashless and cardless payments through merchant presented QR Code (MPQR) and Person to Person (P2P) transfer to send and receive funds from their wallet to other registered Doha Pay wallet users. With the passage of time, Doha Bank will keep on adding more features on the Wallet.

For now, only DohaBank account holders can utilize this service. If you don’t have account with Doha Bank please visit, https://qa.dohabank.com/apply-now-for-current-account/

The app is available for Android and iOS users on respective app stores. Click here for iOS and Android.

If the user phone has been lost or stolen, call Doha Bank Call Center 4445-6000. The wallet will be immediately blocked. User can however enroll the cards on another device.

Note, the user can continue using the physical cards as this action will have no impact on them.

If the old card of the user has been replaced, the user will not be able to use the service pertaining to that card through the wallet. The user must add the new card to the wallet to continue using Doha Pay services. If there are multiple cards in the Wallet, user can continue using other cards without any impact.

In case, if the physical cards (Debit / Credit) are lost or stolen, the customer should immediately contact the call center (4445-6000) to block the cards. As soon as cards are blocked in Doha Bank system, transaction through Doha Pay Wallet will get declined.

Wi-fi / cellular data will be required for operating the Doha Pay App.

If the user decides to delete all the cards from the wallet will have no effect on physical cards. User can continue to use physical cards normally. Users can add their credit and debit cards back into Doha Pay Wallet at any time.

The supplementary card holders can register to Doha Pay wallet and utilize the wallet services.

Note: While adding the card (through scanning or manually) to the wallet, the OTP will be sent to the primary card holder. To import through online banking, the primary card holder will need to enter his / her online banking login credentials.

The user can configure the Doha Pay wallet with same user ID on different devices, however, he can login through only one device at a time. If a user is logging into the second device, he /she will be automatically logged out from the first device.

No, the user cannot register more than once by using same mobile number.

Note: If the Doha Pay wallet user exceeds the above limits, the transactions will be declined.

Under “Manage Profile”, the user can choose the option for deactivating the wallet. Once the wallet is deactivated all the cards linked to that wallet will also be deleted.

The user can reset the wallet PIN by selecting Forgot Wallet PIN option from the Login screen. Please follow the below steps:

Step#1: The user will enter his registered mobile number. An OTP will be sent which the user needs to enter correctly.

Step#2: The user will be directed to setup new Wallet PIN.

Note:

In case the user has added only one card to the wallet, he will need to enter the card details along with the OTP to reset the PIN.

In case the user has added more than one card to the wallet, he will need to enter details for one of the cards along with the OTP to reset the Wallet PIN. The card used to reset the PIN will be the only card retained in the wallet while others will be deleted for security purpose. You can add remaining cards separately following steps mentioned under point 6.

Note:

Doha Bank’s retail, commercial and corporate products are granted at our sole discretion and are subject to the Bank’s terms, conditions and acceptance.