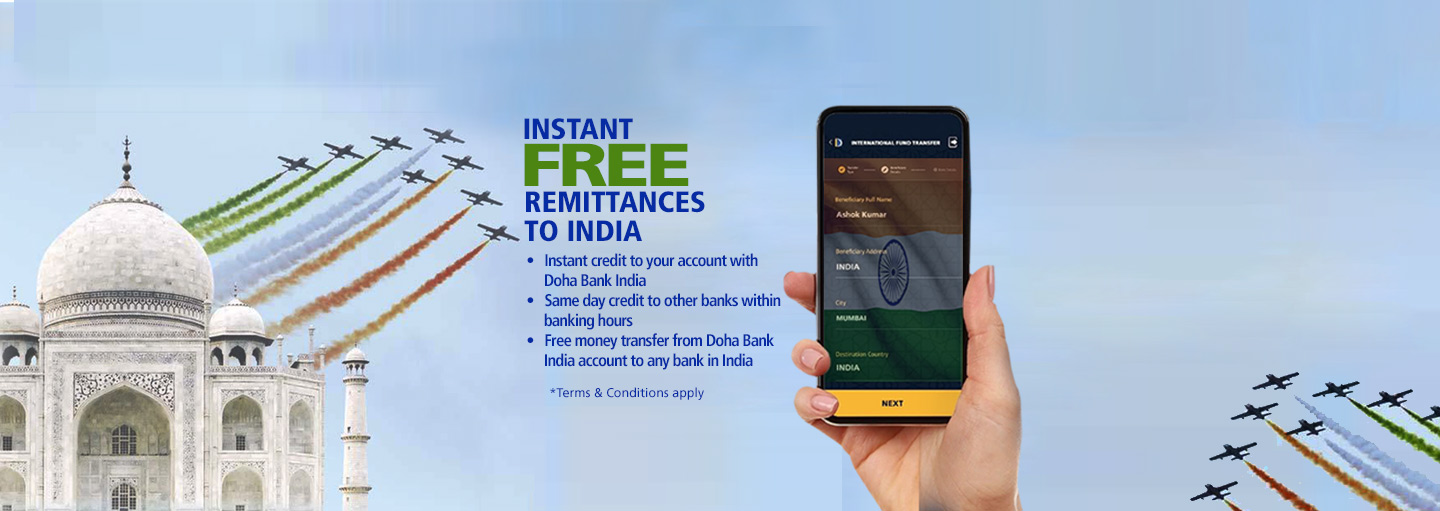

Instant Free Remittances to India

Doha Bank customers can transfer money to India and get credit instantly to their Doha Bank India accounts, Free of cost. Customers can also able to remit money to their accounts with other Indian banks through NEFT.

Open an NRE/NRO account with Doha Bank India at any Doha Bank Branch in Qatar or at Kochi or Mumbai Branch and get the exclusive benefits for Remittances between your GCC account and your NRI account with DB India.

E-remittance to Accounts with Doha Bank India

- Remittance to accounts with Doha Bank India – INSTANT* credit.

- Free Remittance to accounts maintained with Doha Bank India.

- No Back end charge on remittance to accounts maintained with Doha Bank India.

- Remittance credits are subject to regulatory screening of transactions.

E-Remittance to other banks in India

- Credit to other banks – Same day within banking hours in India.

- E-remittance charge applicable for transactions to other banks in India.

- Remittance credits are subject to regulatory screening of transactions.

*Instant credit of Remittances is subject to regulatory screening of transactions.

*Terms & conditions apply.

Features and other Benefits

- Free Remittances to accounts with Doha Bank India.

- INSTANT* credit to accounts maintained with Doha Bank India.

- Preferential Exchange rate for Remittance to account with Doha Bank India.

- FAST and SECURE e-remittance service accessible around the clock via internet.

- Remittance can be done from your Doha Bank Credit Cards.

- Free of Charge online funds transfer from your DB India NRI Account to any bank in India through RTGS, NEFT.

- Remittances sent from overseas to accounts maintained with Doha Bank India is Free of charge, no correspondent bank charges is applicable.

- Remittances sent from overseas to accounts maintained with Other Banks in India (Other than Doha Bank India) will attract correspondent bank charge as per Detail of Fees and Charges below.

*Accounts with Doha Bank India, Remittance credits are subject to regulatory screening of transactions.

Details of Fees & Charges

Charge on E-Remittance for India is as below

For E-remittance to accounts with Doha Bank India

| Platform | Doha Bank Charges | Correspondent Bank Charges |

|---|---|---|

| Online Banking / Mobile Banking | Free | Free |

| Branch | Free | Free |

For E-Remittance to account with other banks in India

| Platform | Doha Bank Charges | Correspondent Bank Charges |

|---|---|---|

| Online Banking / Mobile Banking | QAR 10 | Transaction value up to INR 50,000 – INR 100/- + Service Tax Transaction value above INR 50,000 – INR 150/- + Service Tax |

| Branch | QAR 15 | Transaction value up to INR 50,000 – INR 100/- + Service Tax Transaction value above INR 50,000 – INR 150/- + Service Tax |

Login to DBank Online to Remit

More information on Remittances, please contact

International Resident Client Desk on Email: ircdesk@dohabank.com.qa

To open NRE Account with Doha Bank India, please write to indiadesk@dohabank.com.qa

Download Your App Now

Note:

Doha Bank’s retail, commercial and corporate products are granted at our sole discretion and are subject to the Bank’s terms, conditions and acceptance.